America’s economy has grown for nearly six years and with particular vigor over the last six months. By historical standards, we’re due for another recession. When that downturn comes, it will mark the end of what has been, recent months notwithstanding, a weak recovery. Even though private employers have added nearly 3.6 million jobs since the beginning of last year, the number of American workers is still only roughly where it would have been by the end of 2008 had the financial system not cratered that dark September.

Several numbers point up the shortfall: if employers had added jobs after this recession as fast as they did after the short recession that ended in 1991, we’d have nearly 128 million private jobs now, not about 119 million. Then, too, not all jobs are equal. A family with two breadwinners made slightly less money in 2013 than in 2003, inflation-adjusted, census data tell us. A single-earner family fared much worse, taking in less than a family dependent on one worker made back in the mid-1970s. And many part-time workers want full-time jobs, as well as more predictable schedules.

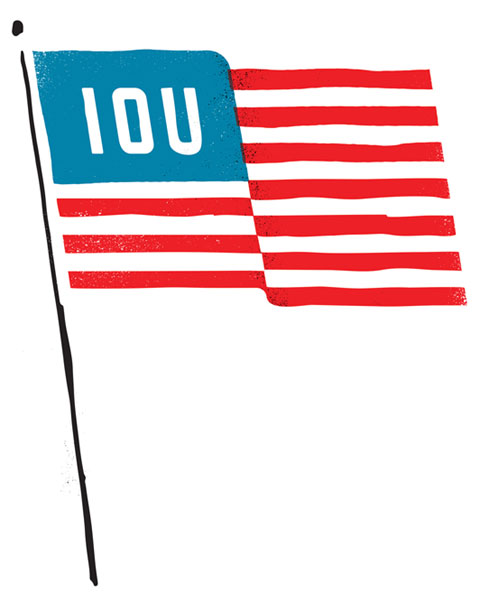

Why has the recovery been so soft? It’s easy for Republicans to blame President Obama or for Democrats to blame President Bush. But the truth is less partisan, and harder. As three of the best recent accounts of the economic crisis explain, the recovery has disappointed because the economy was fragile long before it broke. For decades now, the United States, like the rest of the West, has depended on massive levels of consumer debt to mask weaknesses in jobs and income. As American workers made less money competing with Asians and Eastern Europeans for jobs, they borrowed more, until the U.S. economy owed trillions of dollars to the rest of the world. The economy crashed because its debt levels were unsustainable.

Regrettably, President Obama hasn’t used the crash as an opportunity to rebuild with stronger foundations. Instead, we’ve spent seven years doubling down on the mistakes that got us into this mess. It’s not too late, though, to change course; but first, it’s necessary to see what happened—and why.

After recessions, economies usually bounce back—but to what, in America’s case? By 2008, the U.S. economy was disastrously out of whack. In his 2014 book, The Shifts and the Shocks: What We’ve Learned—and Have Still to Learn—from the Financial Crisis, Martin Wolf, the Financial Times’s chief economic commentator, explains how the U.S. and the rest of the West failed in the globalizing decades leading up to 2008. In a healthy free-trade system, one country makes a product or delivers a service because it’s good at it (Costa Rica and bananas, say, or the U.S. and movies), and sells it to another country; in return, the exporting country imports something that it’s not especially good at making. Since most countries tend to be good at making or doing something, none should be left buying a lot more than it sells—at least, not for years on end. And if a country were to try to keep buying more than it sold, other countries eventually would make it stop, by refusing to extend credit for otherwise unaffordable purchases.

That’s not what happened between the United States and China—now the two largest economies in the world—particularly in the new millennium. Wolf rightly recognizes that millennial globalization has “produced impressive results, notably the successful integration of China . . . into the world economy, together with large reductions in mass poverty” in that country, India, and elsewhere. Still, Wolf shows, “the once-in-a-century impact of the rise of China” hasn’t gone all that smoothly. “A crucial aspect” of the global economic crisis was “the rise in global imbalances, with emerging economies deciding to export capital to advanced countries that the latter proved unable to use effectively.” Nowhere was the imbalance greater than between the U.S. and China. Three decades ago, the two countries had evenly balanced trade—we sold them a small amount of stuff, and they sold us a small amount of stuff. By 2008, however, the U.S. had accumulated a $1.8 trillion trade deficit with its fast-expanding trading partner, government figures show. In simple terms, that means that we bought nearly $2 trillion more from Chinese producers than we sold back to Chinese purchasers. Such a massive disparity can’t last forever.

In a real free market, the imbalance would have partially fixed itself. As America bought more things from China, the value of China’s yuan would have gone up, making its exports pricier, and thus less competitive. Instead, Wolf observes, China, keen to keep its job growth exploding by maintaining a high level of exports, artificially kept the value of its currency lower than it should have been, thus keeping those exports cheap. It did this by holding on to the U.S. dollars it received for its exports, instead of converting them into yuan. By 2008, China held $2 trillion in U.S. currency, mostly in Treasury bonds and mortgage bonds. China’s insatiable appetite for U.S. debt allowed Americans to borrow more money more cheaply—temporarily easing the pain for American workers who’d lost jobs and income to global competition. (Former Fed chairman Alan Greenspan warned of the same imbalances in his 2007 memoir, arguing that in the face of our big deficit with China, America had little control over the Chinese money that was flooding U.S. credit markets.) But, as Wolf concludes, “transferring the excess savings of the Chinese into the wasteful consumption of Americans made no sense. Generating a huge financial crisis as a result was worse than senseless.”

Wolf doesn’t blame the free market for the cataclysm. China’s monetary policies fall under the category of “state capitalism,” he believes, in which government leaders manipulate markets to achieve desired political outcomes. Indeed, he laments that the crisis has dealt a “blow to the prestige of Western financial capitalism”—and to democracy itself.

In The Age of Oversupply: Overcoming the Greatest Challenge to the Global Economy, Daniel Alpert argues that America and the global economy are struggling with “an oversupply of labor, productive capacity, and capital.” Too many people and too many dollars are chasing after insufficient work and investment opportunities, thinks Alpert, a veteran financier who founded the boutique investment bank Westwood Capital 20 years ago.

The collapse of the Soviet Union and the state-directed opening of China’s economy helped “doubl[e] the global labor supply in the free market in the past two decades,” Alpert writes. “Today, the world has a market labor force of roughly three billion people,” and “nearly half live in China, India, and the former Soviet Union.” There are thus more people around the world looking for work—and they push the price of labor (wages) down. Ironically, Alpert says, “the demise of the socialist experiment” in Eastern Europe and Asia “set the stage for the greatest threat yet to the supremacy of the United States and other advanced democracies.”

If you’re a software engineer in India or a luxury shop clerk in Beijing, life has never been better. But there’s no getting around it: such global gains have come at the expense of U.S. workers without solid college or technical education—a group that still comprises a majority of working-age Americans. The last time workers received at least a half-share of the nation’s GDP was 1974, Alpert reminds readers, and the reason is that “labor is no longer a scarce or valuable resource.” The fact that 41 percent of American children are now born out of wedlock—more than double the 1980 rate—has hurt workers, too, a cultural change Alpert doesn’t address. One working parent generally can’t support a middle-class family in the U.S. up to the same standard that he or she did in the past, as those census numbers show. And if the working parent is a single mother, reaching anything close to that level of support is nearly impossible.

“Competing against nearly two billion new workers from poor countries” was never going to be easy, Alpert acknowledges. But America made the “worst possible choices” as it tried, or didn’t try, to help beleaguered working-class and middle-class workers. Rather than finding ways, say, to reduce education and health-care costs to ease the burden for people losing ground, the government—via loosened regulatory standards for mortgages, low interest rates, and other measures making it a cinch to borrow—“pacifi[ed] millions of Americans with easy credit.” Sixty percent of Americans saw their real incomes fall, but they didn’t complain because the “shower” of easy money “allowed them to make up for lost income and maintain living standards—at least for a while.”

The result: private debt “on a scale no nation has ever before confronted.” Household debt in America, driven especially by mortgages, more than tripled between 1981 and 2008, while the population expanded by just 37 percent. As countries with cheaper workers piled up surpluses, they invested that money in American consumers with “a seemingly limitless appetite for incurring debt of every kind.” By the end, “borrowers were sought everywhere,” until the only ones left were people who couldn’t even make their first mortgage payments. “Instead of a balanced rise of both supply and demand”—that is, newly rich workers around the world demanding a roughly comparable amount of goods and services from the countries to which they were selling—“we’ve seen a totally skewed situation”: the trade and financial imbalances that Wolf describes.

No politician had the will to stop Americans from getting drunk on debt—let alone address the causes of the profligate borrowing—before it was too late. But why has the recovery been so weak? In their 2014 book, House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again, Princeton economics professor Atif Mian and University of Chicago finance professor Amir Sufi explain why the recovery was never going to be like a typical postwar business cycle, with a quick bust followed by a strong boom. Mian and Sufi, like Wolf and Alpert, point to household debt as a chief culprit of the collapse. They go a step further, likening the crisis to that of the 1930s. “Both the Great Recession and Great Depression were preceded by a large run-up in household debt,” they note. Between 2000 and 2007, household debt doubled, to $14 trillion. The debt-to-income ratio rose from 1.4 to 2.1, meaning that people were using debt to buy things that they couldn’t afford—putting them more in need of the wage gains that they weren’t getting to pay for the higher debt. Similarly, “consumer debt as a percentage of household income more than doubled during the ten years before the Great Depression,” the authors explain, quoting 1930s-era economist Charles Persons on the stark reality unveiled by the market meltdown: “Our period of prosperity in part was based on nothing more substantial than debt expansion.” That’s not entirely true; then, as now, America was producing the real innovations that fire economic growth. But our optimism—or ability to delude ourselves—outran the pace of those innovations in both periods.

The Great Recession, like the Great Depression before it, was marked by a devastating consumption crunch. When people couldn’t borrow anymore, they couldn’t maintain the freewheeling spending that had powered the economy for the previous decade. And the authors present data from across more than a century, and across the world, showing that “the bigger the increase in [household] debt” before a recession, “the harder the fall in spending.” Ireland had one of the wildest debt binges before 2008, and then one of the most acute spending contractions.

In America, the fall in spending seemed at first mysterious to some, especially those living in regions where housing prices hadn’t caved. But the effects of burst housing bubbles radiated everywhere. Indiana’s housing prices hadn’t dropped significantly when the crisis worsened, for example—but Monaco Coach, headquartered there, nevertheless had to lay off 1,430 people in 2008 as house prices in places like California’s Central Valley, Florida, and Arizona plummeted. Customers from those and similar locales could no longer afford to purchase the firm’s camper-style vehicles. Owing more money on their houses than those houses were worth and struggling with heavy credit-card debt, customers—and the jobs associated with them—weren’t coming back anytime soon. The heavily indebted cut their spending three times more severely than did those who owed less, the House of Debt authors point out. In California’s Central Valley, as residents’ net worth fell 50 percent, spending fell by almost a third. As people cut back on manicures and babysitting, manicurists and babysitters grew poorer, too.

The fact that the people collectively owing the most (relative to income) were the poorest, with their “wealth” tied up in their homes, widened the inequality in the U.S. economy, explain Mian and Sufi. Before the recession, the top 10 percent of American households owned 71 percent of the nation’s assets; by 2010, that percentage had climbed to 74 percent. As the authors note, our “financial system’s reliance on mortgage debt . . . concentrate[d] the risk on the homeowner” least able to bear that risk. “The net worth of poor home owners was absolutely hammered during the Great Recession,” they say, “collaps[ing] from $30,000 to almost zero.” The people in the lowest income quintile found themselves back where they’d been, in terms of savings and assets, in 1992.

If not for politics, a straightforward solution to this debt overhang would have been to cut the amount of money that people owed on their homes. Mian and Sufi scathe Washington for failing to call for (or even require) such reductions. “Principal forgiveness” on mortgages “would have resulted in a more equal sharing of the losses” from the housing crash, the authors argue, because lenders—wealthier people—would have lost as much as their poorer borrowers. In The Shifts and the Shocks, Wolf makes the same point about Germany and Greece. Germany, like most creditor nations, “insists that the difficulties of borrowers are entirely their fault.” Rather than blaming borrowers, it makes more sense, Wolf believes, “to put the blame on the stupidity of creditors”—such as surplus-rich Germans who lent to debtors in Greece, Ireland, and other nations. In practice, neither party succumbed as much to stupidity as to a herd mentality. But it’s certainly fair to make both sides take their losses; protecting creditors, but not debtors, is bad market economics, as well as unjust.

Regrettably, Mian and Sufi contend, housing policy during the earliest years of the Obama administration adhered to the view—advocated ceaselessly by banks and government officials close to banks—that reducing mortgage debt would inflict substantial harm on the banks and that this “would be the worst thing for the economy.” The authors compare the leaders of 2008 unfavorably with the leaders of 1819, when Washington, as well as the states, “responded aggressively to the needs of indebted individuals, in particular farmers,” by pushing for debt forgiveness.

But another force stood in the way of mortgage reductions: the American public. Mian and Sufi cite CNBC personality Rick Santelli’s famous anti-bailout outburst in 2009—the one that launched the Tea Party—as a key force in discouraging mortgage write-downs. “Natural reactions” to a debt binge “are moral judgment and outrage,” the authors admit. So Americans wound up stuck with all their bad debt—and an economy that would struggle to grow through it for years to come.

Washington’s post-2008 actions, along with similar steps taken by the rest of the world, set the postcrash economy on the wrong path, all three books maintain. Though the authors don’t say so, Obamacare hardly helped, imposing an expensive new mandate and regulatory uncertainty on employers as they struggled with the steepest drop in consumer demand in many decades. But the most obvious problem with recovery efforts has been government reliance on yet more household debt to ignite growth. As Mian and Sufi acidly put it, the West is “trying to cure a hangover with another binge-drinking episode.” Alpert agrees, noting that “in a world awash in cheap money, churning out even more cheap money can’t fuel an economic recovery”—at least not one that avoids the same problems that caused the crash. For his part, Wolf frets that “our big problem is the addiction to ever-rising debt, and the most worrying debt is not the public debt with which policymakers are obsessed but private debt.” Writes Wolf: “The belief that . . . private borrowing is the cure has survived all that has happened. The chances are good that reliance on this surprisingly durable piece of conventional wisdom will lead to another and still bigger crisis.”

Since 2008, the Federal Reserve has kept its interest rates at record lows—zero, to be exact—to spur banks to keep lending to people who really can’t afford to borrow any more. A grab bag of government policies has kept mortgage rates at record lows, as well. House prices are finally moving up, and people buoyed by that development are borrowing and spending again. Household debt, after falling between 2008 and 2011, is once again mounting. Our trade deficit with China, after shrinking markedly in 2008 and 2009, is reaching new records. There’s zero reason that America should want young people to keep borrowing from our key trading partner to pay more for houses, as well as for imported goods—unless, of course, the point is to keep a broken system grinding away for just a while longer.

And though the 2009 stimulus law pumped $787 billion into the economy and cushioned the full impact of the recession, that money failed to put the economy on the right path. About one-third of the stimulus money went to households via tax cuts. Such a policy was “much less effective than household-debt restructuring”—which would have saved the same households money on their mortgages—when the “fundamental problem with the economy is excessive private debt,” observe Sufi and Mian. Moreover, adds Alpert, this Keynesian fix breaks down when “that cash may just result in busier Chinese workers in Shenzhen.” Another third of the stimulus flowed to state and local governments to avoid layoffs of government workers. Firing public workers during a recession isn’t a good idea. But the real problem that state and local taxpayers face is excessive bills for public-sector pensions and benefits. Washington made no move to tie the stimulus to long-term benefit cuts, which would have put American finances on surer ground.

Much of the remainder of the 2009 stimulus went to infrastructure. Spending the entire stimulus and then some “to repair and expand the nation’s infrastructure would have had an enormous impact,” Alpert writes, “but that’s not the stimulus Congress passed.” One problem was that the most complex infrastructure projects, which the nation needs, were not “shovel-ready.” Instead, state and local governments spent their infrastructure money on repaving and repairs—necessary work, yes, but not strategic investments for future growth. But given that the recession was always going to be lengthy, we would have been better off spending the money more slowly and smartly.

What, then, should we be doing economically, going forward? The goal remains what it should have been back in 2008: get the economy to generate higher-paying jobs and change the incentive structure for spending beyond our means so that we don’t sink ourselves—and the nation—in unpayable debt.

It may be more efficient to start with the symptom, not the problem. If you’re shooting heroin because you’re unhappy, it makes sense to stop shooting heroin—and then figure out why you’re miserable. Modern history shows that as long as we can rely on debt to mask our economic weakness, we will. Thus, the nation must finally fix the “too-big-to-fail” financial system that has channeled so much bad debt to American borrowers, assuming that it will never pay the consequences of its risky lending. The “entire financial system is based on explicit or implicit government guarantees,” say Mian and Sufi, acknowledging the decades-long history of taxpayer bailouts of lenders. (See “Too Big to Fail Must Die,” Summer 2009.) “The idea that financial firms should never take losses is indefensible. They are in the business of taking risk.” In a useful overview of proposed financial reforms over the decades, Wolf describes, without endorsing, everything from modest new limits on borrowing by the financial industry to abolishing banks altogether and having government create money directly (doing so would be “politically dangerous,” he says, with considerable understatement). But the simplest fix for finance is strictly to cap borrowing, for lenders and borrowers alike.

Authors of all three books accordingly take aim at mortgage financing. Of America, Wolf notes that “in a country supposedly dedicated to the ideals of market economics . . . the most important social function of finance—lending for home purchase—has become almost completely nationalized,” thanks largely to the government takeover of Fannie Mae and Freddie Mac, the nation’s biggest mortgage lenders. The authors all agree with most economists that America should stop subsidizing mortgages through the tax code, by letting borrowers deduct mortgage interest when they pay their taxes. Instead of incentivizing home borrowing in this fashion, Alpert suggests, we should have a five-year tax holiday for Americans who want to put money in savings accounts and other safe investments. A deeper reform would go further, with the government matching savings and investments on a sliding scale for people earning less than six figures.

Mian and Sufi offer a particularly creative reform for mortgages. They suggest that America address “the inflexibility of debt contracts” by making mortgages act more like stocks. That is, if home values in a particular area fell by 30 percent, a homeowner’s monthly mortgage payment would decline by 30 percent. The balance owed would automatically fall, too. Payments would rise again (up to the original amount owed) as home prices increased. To compensate themselves for this “automatic principal reduction,” mortgage lenders would keep 5 percent of the profits from any home sale or refinancing. Such a system “would have benefited everyone” in 2008 “by protecting the entire economy against foreclosures and the sharp drop in . . . spending,” say Mian and Sufi. What they call “automatic stimulus”—financed by private lenders—would have saved 2 million jobs, they claim.

What else can the politicians do to boost incomes and spark long-term, substantial economic growth? Alpert and Wolf agree that it’s not too late to do the infrastructure spending that we should have done more than half a decade ago. Undeterred by the American political class’s lack of interest in roads, bridges, dams, and transit, Alpert suggests a $1.2 trillion, five-year public investment in infrastructure, which, he says, would create 5.5 million jobs. Alpert is willing to anger Democrats by calling for the suspension of federal laws that artificially drive up wages for construction workers on government-funded infrastructure projects.

Alpert also warns that we should build the right infrastructure—a fundamental distinction that many stimulus advocates missed the first time around. “Japan built highways to nowhere when it should have invested more in cities,” he says. One project he suggests is “the new rail tunnel under the Hudson River” between New York and New Jersey, which New Jersey governor Chris Christie abandoned in 2010. The tunnel “would not only create thousands of jobs, but also save [commuters] millions of hours.”

Indeed, infrastructure’s impact on the private sector is more important, long term, than any temporary effect its construction might have on job creation. The purpose of bridges and subways is, as Alpert implies, to help private-sector workers get to work faster and thus be more productive. New York City punches far above its weight in terms of productivity and income, but it risks weaker economic growth over time if it fails to invest in better subways and buses to keep up with its swelling population. We might as well spend the money now, putting some of the cheap credit flowing in from China toward boosting efficient private-sector production in the years ahead, rather than sustaining our debt-enabled consumption. Alpert also says the obvious: we’ve still got to cut health-care and education costs.

None of these things is impossible. So why haven’t we done any of them? The authors sometimes make the wrong diagnosis. Mian and Sufi are incorrect, for example, in saying that “the financial system benefits very few people, and those few have a vested interest in staving off any reform.” The problem is the reverse—that the current economic system benefits lots of people—at least, in the short term. Take away people’s cheap mortgages by making the reforms that Mian and Sufi suggest, and they’ll understandably scream. Take away the health-care insurance they get from their employers and make them pay cash for it directly, and they’ll scream, again. That’s why nothing much has happened.

Wolf castigates the political and business classes’ failure to level with the public in the strongest terms. “The economics establishment failed,” he says flatly, and their continued failure will have serious consequences, he warns: “Angry and anxious people are not open to the world.” That is: if elites want to save free global markets, they should do a better job of responsibly governing them. Otherwise, next time will be worse. “The loss of confidence in the competence and probity of elites inevitably reduces trust in democratic legitimacy.” That’s already happening, as voters around the world grow ever more dissatisfied with mainstream politicians.