In its extraordinary actions over the past few months, the American government is trying to do the opposite of what it did the last time an economy-wide financial crisis rocked the country. During the Great Depression, policymakers chose to stand by and watch as banks failed and as spooked savers hoarded dollars, gutting spending and investment. The government, instead of expanding money and credit, allowed it—indeed, encouraged it—to vanish from the economy. Scholars, most notably the late Milton Friedman, long ago convinced mainstream economic thinkers that this monetary policy blunder pushed the nation and then the world into a long-term contraction during the thirties and kept it slumping for a decade.

So in the months and years ahead, we will see if a vastly ambitious government expansion of money and credit, probably far beyond what Friedman had envisioned, can fix today’s crisis, in which, after the housing market began to collapse in 2006, private lending and borrowing have screeched to a halt for the first time in modern history. During the last few months of the Bush administration, the government embraced its traditional role of money creator and also, with gusto, a brand-new role of direct lender of first and last resort to the private sector. It’s unlikely that President Obama will mandate any change in philosophy. But there’s no guarantee that any of it will work.

To understand why credit is so important, you need to understand money. Unless we want to barter for everything—I’ll write you this article, and you can cut my hair in return—we need a stable, objective store of value to exchange: in America’s case, the dollar. As the economy naturally expands—the result of both a growing population and increased productivity, through technology and the like—the money supply, too, must expand.

The Federal Reserve, an independent body created by Congress, plays a vital role in this task. If the Fed thinks that money is too “tight”—that a lack of money growth is squelching economic growth—it can cut the interest rate that it charges banks to borrow directly from the government, and it can also use its own immense reserves of dollars to buy bonds in the market, thus flooding money into the economy. If it deems money too “loose”—when too much money chasing the same amount of goods and services around threatens to increase inflation, raising the price of a hat from $10 to $20, say, and eroding the dollar as a reliable store of value—it can raise interest rates and sell bonds to absorb dollars back into its coffers. The goal is to keep prices generally steady. In practice, the Fed considers itself to be doing a decent job of regulating the money supply if prices expand just a little—say 2 percent—each year.

But the Federal Reserve isn’t alone in determining the money supply. Regular people, too, must have enough confidence in the Fed’s ability to regulate money to “store” their own capital in dollars. If they lose confidence in the dollar, they’ll do business in foreign currencies or gold instead. Just think of what has happened in Zimbabwe, where the government’s disastrous mismanagement of inflation has obliterated its citizens’ confidence in the nation’s paper money, leading them to abandon it en masse and destroy whatever remaining value it had.

Credit is money’s natural derivative. It’s impossible for everyone to have the exact amount of money that he needs at exactly the right time. If I’m making $75,000 a year as a young software engineer but don’t have a family and I rent a small apartment, I probably have too much money. So I keep some in a savings account—where indirectly, through the bank, I lend it to someone who doesn’t have enough money when he needs it: maybe someone earning about as much as I do but who, with a new wife and a baby on the way, wants to buy a home.

Here, too, the Fed plays a big role: when money is “easy” because of low interest rates, banks can borrow and lend cheaply. But global markets are equally important. A few years ago, Chinese investors were happy to lend to Fannie Mae and Freddie Mac to create cheap American mortgages; now, despite the Fed’s best efforts, they’re not so interested.

Like the money supply, credit should expand steadily, because an expanding populace as well as expanding businesses need ever-greater access to funds. Further, as the value of assets—from stocks to houses to office buildings—rises steadily with economic growth and productive use, they can support greater borrowing themselves. In fact, from 1952, when the Fed started keeping consistent records, household debt, encompassing everything from mortgages to credit cards, did expand, month after month after month, until it declined in the fall of 2008.

American homeowners, consumers, and corporations owe roughly $25 trillion, according to Federal Reserve data. But American banks lent only about $8 trillion of that total directly—that is, keeping the loans on their own books. Bondholders and other traditional lenders provided another $7 trillion. The remaining $10 trillion, according to Standard & Poor’s, came from the securitization markets, a relatively new invention. Starting in the eighties, banks decided that they didn’t need the bother of holding on to loans, such as mortgages, forever. Instead of being permanent middlemen, they would become temporary matchmakers, structuring all those mortgages and credit-card obligations into securities, much like corporate bonds, and selling them to global investors. (Often the banks did serve as managers of assets for those investors, but this role was not the same as being a direct lender.)

The purchasers of these “securitized” financial instruments—from the Luxembourg government to Finnish school districts to midwestern pension funds—no longer had the protection of the bank’s own credit in the middle to assure payment in case the underlying borrowers defaulted. But these investors didn’t worry much because, particularly over the past decade, securitization seemed such a sure thing. Global investors were confident that American bankers, through their financial-engineering and technological prowess, had made lending to California home buyers or Florida credit-card holders almost risk-free.

The securitization markets quietly started to close down in the spring of 2007, after sinking home values and rising loan losses proved how fragile their financial engineers’ assumptions had been. They seized up utterly 18 months later, in the autumn of 2008, and global investors now won’t lend money through them at any price. More than a third of our private credit markets, then, are gone.

Now the government is working desperately to figure out a way to replace them. Without access to easy borrowing, workers can’t buy cars. Farmers can’t plant crops. Toy importers can’t pay their Chinese factory suppliers, meaning that the factories can’t pay their workers. “The long-term objective should be sober and modest rates of growth of money and credit, not the double-digit growth rates . . . experienced in recent years,” says John Greenwood, chief economist at the Invesco fund-management company in London. “Meantime, it is equally important to prevent an absolute shrinkage of money and credit, as this would only exacerbate the economic downturn.”

The economy saw a measure of how a financial shock becomes an economic shock in November, when the nation lost more than half a million jobs, the most monthly hemorrhaging in over three decades. The grim news showed how swiftly Depression-level demand drop-off can arrive. Every class of employer, from domestic and foreign automakers to global steel producers to diamond retailers, began to announce double-digit-percentage sales declines from last year. Even the banks—fearful of other banks’ losses on everything from home mortgages to credit cards—stopped lending to one another. Double-digit-percentage production freezes and layoffs accompanied the death of demand, with storage lots at California’s biggest port filled with thousands of foreign-made cars because the dealers’ lots were too crowded to hold any more.

In trying to stanch the bleeding of credit out of the economy and get someone to buy all those orphaned cars, the Fed and the U.S. Treasury are using a particular handbook: “The Great Contraction,” part of Milton Friedman’s and Anna Jacobson Schwartz’s lengthy A Monetary History of the United States, 1867–1960. Friedman and Schwartz compiled reams of data and historical documents to illustrate a simple thesis: the catastrophe of the Depression wasn’t the natural hangover of the late 1920s speculative excesses, as many believed (and still believe), but the result of the inaction of the Federal Reserve during the early 1930s.

The Fed dithered as banks failed. A first wave went insolvent after lending money against speculative instruments like stocks whose values had plummeted. These failures cascaded, though, when frightened depositors, back then without any FDIC-style government guarantee of their savings, rushed to withdraw their money. The panic spread further. Even relatively healthy banks began to fear that they’d be the next to face a run and started to sell off all noncash assets, like stocks and bonds, so they’d have money on hand in case of depositor panic. This forced selling drove down the prices of those investments, pushing more banks over the brink and causing yet more dread. As the banks failed, of course, credit dried up. As frantic depositors removed physical dollars, they also took with them, invisibly, all the money that belonged to other savers who didn’t get there as quickly, as well as potential credit that banks might have lent to borrowers.

A dismal cycle emerged. The shrinking supply of money and credit, plus falling asset values exacerbated by the banks’ forced selling, dragged prices down. Falling prices made it even harder for borrowers to pay back their existing loans, since the amount of the loan stayed steady while the value of the asset that the loan had paid for, and often the borrower’s income, was declining. So more banks failed. And because the prices of goods fell faster than wages, people lost their jobs as employers slashed costs to keep ahead.

The Fed, Friedman and Schwartz argued, should have asked the Treasury to print up new money and then lent it generously to the banks, so that they would resume lending and borrowing; reinflation, price recovery, and economic recovery would have followed—much sooner than they ultimately did. “Throughout the contraction, the [Fed] had ample powers to cut short the tragic process of monetary deflation and banking collapse,” Friedman and Schwartz wrote. “Had it used those powers . . . in late 1930 or even in early or mid-1931, the successive liquidity crises that are . . . the distinctive feature of the [Depression] could almost certainly have been prevented. . . . Moreover, the policies required to prevent the decline in the quantity of money and to ease the banking difficulties did not involve radical innovations.”

In 2002, Ben Bernanke, then a member of the Fed’s board of governors, spoke at a party to honor Friedman’s 90th birthday. Noting that he had first read “The Great Contraction” as a grad student at MIT, Bernanke observed: “I would like to say to Milton and Anna, regarding the Great Depression: You’re right. We did it. We’re very sorry. But thanks to you, we won’t do it again.”

Say this for Bernanke, now the Fed’s chairman: he wasn’t kidding! Six years after his speech, Bernanke’s Federal Reserve, in concert with the Treasury Department, has launched a full-throttle effort to flood the dried-up economy with money and credit and to prevent millions more jobs from disappearing in the current contraction. Part of this effort involves aggressively expanding the money supply using the familiar set of tools. The Fed has slashed the interest rate at which it lends to banks so that those banks, in turn, can borrow and lend more dollars. It has also deluged the economy with money by buying bonds: stocks of money in checking and savings accounts are now way up. The Fed has sloshed the economy with enough money that banks should theoretically lend to one another at a zero percent interest rate. These actions carry the grave risk of runaway inflation, but they aren’t unorthodox.

But the Fed doesn’t think that these old-fashioned methods are enough on their own to jump-start today’s private credit markets. It can create the money, but the private infrastructure to get it where it needs to go to grease the economy—those securitization markets—no longer exists. The Fed thus finds itself stuck in a vicious loop: it can pump out money and cheap credit, but the banks, scared stiff by the poor decisions they’ve recently made in granting credit, will just lend it back to the government by buying safer Treasury bonds. One measure of how thoroughly the banks have abdicated their role in distributing credit is in Treasury bond yields. In December, investors accepted a negative interest rate from the government on one-month Treasury bills; they were willing to pay the government for the comfort of safety.

The Fed, of course, could just wait for its decisive traditional steps to have an impact. In fact, by mid-December, signs emerged that they would slowly work, with investors lending to the highest-quality companies, like Verizon Wireless, through simple financial structures. Eventually, banks and other global investors would grow tired of the tiny and even negative returns that the government has on offer and start to put their money to work by taking incrementally greater risks in the private markets again, step by painful step. The problem: nobody knows when “eventually” is or what newly “normal” levels of credit will be. “Eventually” could be two weeks away or five years, and the Fed doesn’t want to find out. So the Fed and the Treasury are risking more than a trillion dollars to shortcut this process, particularly with two major “radical innovations,” to quote Friedman and Schwartz.

The first concerns those old-fashioned credit providers, the banks. The banks’ virtue is that their office towers and management teams, unlike the private securitization markets, still exist, even if their assets and lending abilities are shrinking fast. The Treasury announced last October that it would directly provide $250 billion to commercial banks, effectively replacing the private shareholders who once provided this “seed money” as a base for the banks’ lending. Under the Treasury’s plan, $125 billion went to the nation’s nine largest banks—JPMorgan Chase, Bank of America, and Citigroup among them—whether they wanted it or not, and the rest will go to hundreds of smaller banks upon application and approval. The government added that the FDIC would guarantee commercial and investment banks’ new debt for three years, so that potential private lenders could provide banks with money to finance new loans without worrying that they would lose it.

But this extraordinary action actually points up the government’s limitations. Banks are hoarding much of their new government capital against future losses, rather than using it to make new loans. This behavior isn’t irrational, as many government officials seem to think—among them House Financial Services Committee chairman Barney Frank, who has chastised the banks for their reluctance to lend. The banks just aren’t sure how many existing borrowers—from credit-card holders to big corporations—are going to default, and they’re also unsure whether there’s more federal money on tap if borrowers keep defaulting in large numbers. Banks also want to hoard capital because their private investors—those few left—want them to. It’s unlikely that the market will look favorably any time soon on banks that lend as aggressively as they did a few years ago.

Moreover, borrowers aren’t as interested in taking out loans, cutting demand for credit even as the supply dries up. It’s no surprise that they’re balking. Consumer debt, including mortgage debt, more than doubled between 1999 and 2007, largely based on unsustainable increases in home and other asset prices. With home prices plummeting, consumers who had depended on constant refinancings to take cash out of their homes simply can’t do it any more. As for businesses, they didn’t swell their own debt by quite so much during those years, but consumer borrowing often drove their growth. Customers used money, often borrowed from their homes, to purchase goods and services, from home renovations to plastic surgery. As two bankers in Los Angeles noted recently, small businesses can hardly increase their borrowing when the revenues against which they’re borrowing are down 20 to 30 percent.

“When will the household sector and nonfinancial corporate sector have the capacity to take on additional debt?” asks Invesco’s Greenwood. “In cases that I have studied, such as the de-leveraging in Japan after their bubble burst in 1990, or the non-Japan Asian economies after the Asian financial crisis of 1997–98, the de-leveraging process took many years, and the willingness of households and corporations to take on new debt was very limited in the aftermath of both crashes. During those years, banks’ balance sheets grew only very slowly—in the low-single-digit percentages. The U.S. is likely to experience the same repugnance for debt going forward.”

Price-Fixing Begins at Home

As City Journal went to press, the Federal Reserve and the Treasury Department were mulling over a plan that would obliterate all market signals from the mortgage industry. The plan demonstrates once again Washington’s perverse belief that the cure for decades’ worth of government distortion of the housing market is more government distortion.

Normally, Washington doesn’t directly control mortgage rates. Yes, the Fed helps control general interest rates for all kinds of borrowing through its interest-rate policies. And the government’s long-assumed guarantee of mortgage behemoths Fannie Mae and Freddie Mac—until it quasi-nationalized the two companies last summer—also kept mortgage rates lower than they would otherwise have been for decades.

But now, the government may take a giant step further. The Fed and the Treasury may set home-borrowing rates in the next few months by purchasing mortgages directly from Fannie Mae and Freddie Mac, and from other mortgage lenders, at a fixed price that would dictate an interest rate of 4.5 percent for new home buyers, as well as, possibly, for owners of existing homes who want to refinance their more expensive loans. After news of the tentative plan got out in December, mortgage rates plummeted to just above 5 percent, the lowest level in four decades.

The government’s reasoning is obvious, if wrongheaded. It wants to keep housing prices from falling further, which would drive homeowners into foreclosure and push banks and investors into deeper distress. To achieve this, the government has to scare up new home buyers, many of whom feel skeptical that prices have hit bottom. So the feds hope to lure buyers with dirt-cheap mortgages, just as they were priced during the housing bubble. The gambit could work—for a while. But in the long run, the federal plan will just make things worse.

Consider the downsides. First, the feds will further warp the housing market. Part of the reason that we’re in this mess is that government policies—from zero percent capital-gains taxes on house appreciation to mortgage-interest tax deductions to support of Fannie and Freddie—long encouraged borrowers and lenders to pour money into houses at the expense of more productive forms of investment. Making easy lending available solely for buying still-expensive houses adds yet another layer of capital deformation. It would be something like trying to reinflate the nineties’ tech bubble by offering cheap government financing only to people willing to buy shares in Pets.com. This time around, such a distortion could delay recovery by directing capital away from where it could do the most economic good and toward yet more investment in houses.

The government may only be delaying an inevitable full correction of housing prices, moreover, since it can’t determine mortgage rates forever. Remember, the government can “fix” rates by purchasing mortgages at a preset price, by bringing potentially hundreds of billions of dollars in mortgages onto either the Fed’s or the Treasury’s books, or both. But the Fed and the Treasury can’t warehouse these mortgages on their books forever. Eventually, the market will figure out that the government’s mortgage holdings are untenable, and it will push up interest rates on them as it anticipates their being dumped. (On debt instruments, when prices go down, as they would in a government sell-off, interest rates go up.) The consequence of such a sudden spike in mortgage rates might well be another big drop in home prices. Could the government engineer a “soft landing” here, carefully managing its sales of mortgages? Sure: it did a great job of engineering a cushioned fall when the housing bubble first burst, remember?

The government’s aggressive action also could delay another inevitable process: “de-leveraging,” or debt reduction. Mathematically, Americans simply cannot afford the debt they’ve incurred over the past decade or so, and they must reduce it. Encouraging them to borrow more money is a very bad idea.

Finally, the government’s cheap and easy mortgages could come with a hidden cost, just as all those exotic mortgages from the bubble era did. Washington’s plan assumes that the Treasury itself can borrow cheaply—that is, for less than the 4.5 percent of these mortgages—for as long as it takes to push these cheap loans. As the government adds its massive new debt to the private sector’s own debt, however, the global markets upon which we depend for all this borrowing may grow queasy. They may figure out, eventually, that America is a democracy of debtors—and that the crudest way for a debtor nation to pay back lots of debt is to print more dollars, thus creating massive inflation.

Just the fear of inflation could push Treasury rates up suddenly, giving the feds no reasonable economic choice but to end their cheap-mortgage program. Of course, politics might allow them to continue it for a while. But the unavoidable result would put us right back where we started, with still-distorted home prices and even higher levels of debt.

—Nicole Gelinas

It’s not just a lack of capital and fear of future losses that are keeping banks from stepping up and replacing the vanished securitization markets as the economy’s credit creators, however. Banks simply don’t remember how to be banks—that is, long-term direct lenders to customers—any more, since the securitization markets have done that job for so long.

For the past decade, banks haven’t served as credit analysts, carefully assessing the capacity of people and institutions to repay debt based on judgments about personal and corporate income and character and future economic growth. Banks instead served as financial engineers, making securities to sell, not loans to keep. Now that the securitization markets have dried up, what the government is asking the banks to do is like asking a hospital that delivers a newborn baby to raise him until he’s 18 years old. But nobody in the private markets trusts the big banks suddenly to become excellent analysts of credit prospects. And even if the banks do their best at the assignment, nobody has any real idea, after a decade of almost unimaginable credit distortion, of how much credit the economy can reasonably support.

If they’re going to become long-term lenders again instead of short-term “securitizers,” even relatively healthy big banks will need a quiet period to make the huge changes necessary for their new role. The government is asking too much in wanting them to circumvent this process and just start lending—and lending even more than they did back before the securitization markets replaced them.

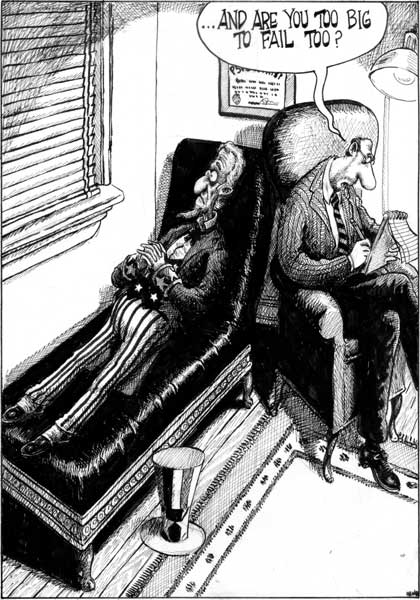

The government’s first great innovation—force-feeding capital to banks to try to get them lending—could harm the economy even after it has recovered. By focusing on the biggest banks, the government is worsening the very problem that helped get us into this mess: the growth of overly complex, too-big-to-fail financial giants.

Of course, big banks have been immensely useful to the economy over the past few decades. It was their capital—and the innovation that they bought with it—that gave customers the modern banking conveniences that they enjoy today, including online bill-paying and ATMs. Gone are the days when you had to rush to the bank by 3 pm on Friday or wind up without cash for the weekend. For a long time, big banks drove small banks to improve their services.

But the economy is on its knees today partly because these banks grew so big and so complex that even their boards of directors—to say nothing of their investors—became ignorant of the risks that their institutions were taking on. The most reckless big banks also succumbed to a herd mentality: they employed similar consultants and MBAs who pursued the same massive bets—that the housing market would never falter, for example. And when credit started crunching and these banks got stuck with securitized loans that they couldn’t sell, the government, reasoning that the banks’ sudden failures would have been catastrophic for an already hurting economy, didn’t want to let them go out of business, as smaller failed banks do. Ignoring the long-term implications, it stepped in to save them.

Now, the government has encouraged the big banks to use their new, government-provided capital to gobble up smaller banks. Because of last year’s flurry of bank mergers, the nation’s top four banks now hold 36.2 percent of deposits in the country, up from 24.8 percent in 2007, according to SNL Financial. We thus may be setting up the next bubble-fueled crisis as we speak—and this time, it may be too big to recover from.

Big, government-guaranteed banks aren’t just risks in themselves. They crowd out smaller, healthy banks, hurting the diversification of the financial system that’s important even when we’re not in a financial crisis. As Congress creates new rules to protect us from the next crisis, small banks will have a harder time than big ones coping with rising regulatory costs. And as the big banks get bigger, they’ll have more pricing and lending power over consumers on everything from credit-card fees to savings-account interest rates. This concentrated pricing power, in the absence of real competition, will spur even more government regulation, often driven by the big banks’ lobbying clout, and even higher costs for smaller banks. “It infuriates me that they can go out and fleece more people,” says Bill Wyckoff, CEO of the tiny 12-branch Labette Bank in Kansas.

Worst of all, the government’s propping up of yesterday’s banking giants may inhibit a natural market correction—one our economy needs so that we can maintain our global competitiveness in financial services. In any industry, when a giant stumbles, a smaller company inevitably rises to take its place—whether it’s Microsoft after IBM faltered or Google after Microsoft stumbled. Without artificial government support for the gigantic legacy banks, healthy, smaller banks could become the next kings. Banks like Wyckoff’s, for example, didn’t go in for the subprime mortgages sold by “snake-oil salesmen” partly because “I have a moral obligation to 92, 94 families” of employees “not to do something stupid,” he says. Such banks could use their healthy positions to increase credit to customers, possibly helping the economic recovery in a subtler manner than the clumsy government can do. Indeed, while Wyckoff’s bank is privately held, so official data aren’t available, he says that he’s making loans just like last year. Many other small, healthy banks are doing the same: the First National Bank of Orwell in Vermont told the New York Times in October that its lending was up nearly 23 percent from a year earlier.

Smaller banks could also drive the next generation of financial-services innovation. Yes, in the past, we got such innovation from today’s big, brand-name banks. But today, with their government support—and whatever favors to the government are implied in return—the legacy banks may become more like public utilities than entrepreneurial centers. Ask yourself: How much innovation have you seen from Con Edison lately?

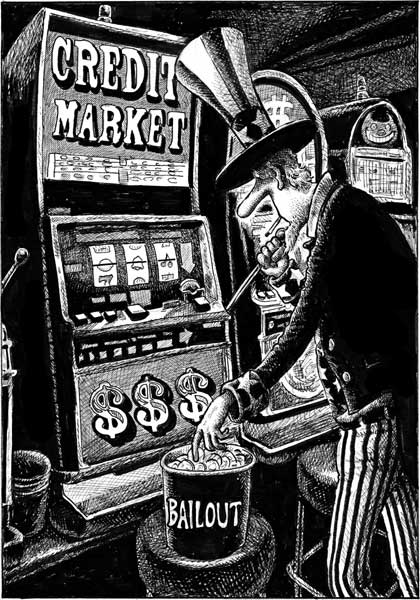

The government hasn’t confined its furious credit-creation efforts to the banks. Realizing that banks simply can’t take over the entire credit-making function that the securitization markets once held, the Fed and the Treasury are now implementing a second radical innovation: devoting hundreds of billions of dollars to replace directly the vanished investors in those markets. Here, too, the government is taking a big risk with recovery and with the future of the economy.

The government’s thinking is that it can create a synthetic, government-guaranteed version of the intricate infrastructure that was the private securitization markets. Before they broke down, the markets worked as follows: some investors, desiring a high return, would take on high risk—agreeing to assume disproportionate losses if borrowers’ defaults exceeded expectations; other investors, not seeking such high returns, would take less risk. Now, the government is preparing to play the part of the high-risk-taker, putting taxpayer money up to entice private investors, including hedge funds, to return to the supposedly safer parts of securitization markets.

But the government could be retarding recovery. The securitization model failed utterly, after all. Private investors will no longer invest in these financial instruments for good reason: they don’t trust the financial engineering behind them. It requires a suspension of disbelief to think that the government can fix this problem by replicating the same securitization model, even if it plays the role of biggest risk-taker. Instead, private-sector entrepreneurs—including, optimally, people who weren’t involved in creating the securitizations that failed—must painstakingly come up with new models to replace the discredited ones and thus help get credit from lenders to borrowers. But the government may overwhelm such innovation by trying to replicate the old, broken model. It’s similar to the government’s bailing out GM at the expense of an upstart like Tesla Motors, which is hard at work building what it thinks are the American cars of the future. Trying to create capital, the government may end up starving good ideas, including good financial ideas, of capital.

The overriding danger with everything that the government is doing, though, is that there’s no natural exit strategy. While the Depression showed that a precipitous drop in money and credit is horrible, that doesn’t mean that risking severe inflation at a time of economic weakness, maintaining failed ideas, and breaking the national bank over some indeterminate amount of time to maintain an artificial level of credit is better. What if, say, five years from now, it turns out that we’ve spent not only time but trillions of dollars trying to maintain an unsustainable level of borrowing, and it all falls apart anyway—but with the government more deeply in hock and hyperinflation destroying confidence in the dollar?

Consider, too, the government’s long history of distorting the private credit markets. A perfect example is Fannie Mae, whose predecessor was created by the government during the Depression to let Americans borrow money to buy houses. For seven decades, Fannie and its younger brother, Freddie—thanks to the cheap funding that came from their implied government guarantee—made sure that private-sector banks were at a disadvantage in the important mortgage-creation business, helping push the banks into riskier activities. The feds could never wean themselves away from their politically powerful role as mortgage guarantors. Will they come to enjoy a new, even more powerful, role in the economy as general providers of what was once private credit?

Despite this bleak outlook, there’s some cause for optimism. First, market forces do still exist, and so far, throughout the credit crisis, they’ve helped discipline the government into admitting reality. As far back as October 2007, the government tried to help the three largest banks hide their losses on bad securitized loans by creating a financial structure in which the banks would segregate the loans and insulate them from market fluctuations. It didn’t, and couldn’t, work; it only delayed the inevitable exposure of losses. And for more than a year now, despite the government’s best efforts to pretend that all’s well, private lenders have made their skepticism about lending any more money to debt-saturated Americans all too clear. The market has insisted, for example, against all odds, that Citigroup must split itself up.

The markets, then, have been very good at realizing how rotten things are. So far, it’s been a fool’s errand to try to deceive them. In the end, if the economy doesn’t recover quickly, it may be the markets that—by eventually insisting that the government pay prohibitively high interest rates to borrow—rein in the government from taking on too much debt. Of course, waiting for a global market verdict could be a dangerous game. We saw how harsh the markets were when they finally figured out the credit bubble and burst it.

Politics provides another cause for optimism. It’s striking that the public, though whipped into financial panic, has consistently opposed bailouts—starting with the first ad-hoc plans to keep people in their unaffordable homes, continuing with Bush administration Treasury secretary Henry Paulson’s “Troubled Asset Relief Plan,” and ending, so far, with the December approval of federal money for the Big Three automakers. Indeed, says William Poole, former St. Louis Fed president and current Cato Institute senior fellow, the glimmer of hope in stopping other bailouts is “political constraint.”

Taxpayers and the markets may understand something viscerally that monetary policymakers and elected officials do not. The real lesson of the Depression may be that there is no straightforward policy fix for such an enormous mess. As Lazard Frères partner Albert J. Hettinger, Jr., wrote in the original introduction to Friedman and Schwartz’s masterpiece: “High-powered money, intelligently administered by a regulatory body, can, as the authors point out, accomplish much. It cannot accomplish the impossible.”