A U.S. Supreme Court justice recounted over cocktails a while ago his travails with his hometown zoning board. He wanted to build an addition onto his house, containing what the plans described as a home office, but he met truculent and lengthy resistance. This is a residential area, a zoning official blustered—no businesses allowed. The judge mildly explained that he would not be running a business from the new room; he would be using it as a study. Well, challenged the suspicious official, what business are you in? I work for the government, the justice replied. Okay, the official finally conceded—grudgingly, as if conferring an immense and special discretionary favor; we’ll let it go by this time. But, he snapped in conclusion, don’t ever expletive-deleted with us again.

Isn’t that sort of petty tyranny? I asked.

Yes, the justice replied; there’s a lot of it going around.

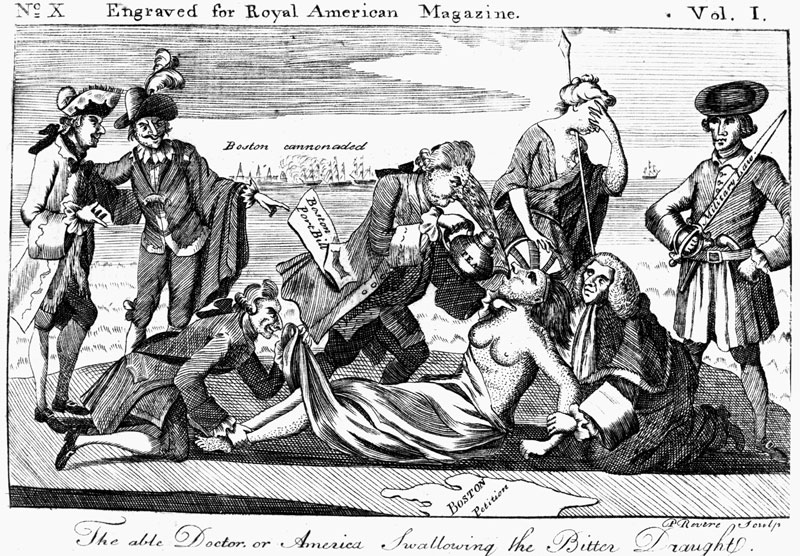

Tyranny isn’t a word you hear often, certainly not in conversations about the First World. But as American voters mull over the election campaign now under way, they’re more than usually inclined to ponder first principles and ask what kind of country the Founding Fathers envisioned. As voters’ frequent invocations of the Boston Tea Party recall, the Founding began with a negation, a statement of what the colonists didn’t want. They didn’t want tyranny: by which they meant, not a blood-dripping, rack-and-gridiron Inquisition, but merely taxation without representation—and they went to war against it. “The Parliament of Great Britain,” George Washington wrote a friend as he moved toward taking up arms several months after the Tea Party, “hath no more Right to put their hands into my Pocket without my consent, than I have to put my hands into your’s, for money.”

With independence won, the Founders struggled to create a “free government,” fully understanding the novelty and difficulty of that oxymoronic task. James Madison laid out the problem in Federalist 51. “Because men are not angels,” he explained, they need government to prevent them, by force when necessary, from invading the lives, property, and liberty of their fellow citizens. But the same non-angelic human nature that makes us need government to protect liberty and property, he observed, can lead the men who wield government’s coercive machinery to use it tyrannically—even in a democracy, where a popularly elected majority can gang up to deprive other citizens of fundamental rights that their Creator gave them. In writing the Constitution, Madison and his fellow Framers sought to build a government strong enough to do its essential tasks well, without degenerating into what Continental Congress president Richard Henry Lee termed an “elective despotism.” It’s to ward off tyranny that the Constitution strictly limits and defines the central government’s powers, and splits up its power into several branches and among many officers, all jealously watching one another to prevent abuse.

When we ask how our current political state of affairs measures up to the Founders’ standard, we usually find ourselves discussing whether a given law or program is constitutional, and soon enough get tangled in precedents and lawyerly rigmarole. But let’s frame the question a little differently: How far does present-day America meet the Founders’ ideal of free government, protecting individual liberty while avoiding what they considered tyranny? A few specific examples will serve as a gauge.

The Supreme Court’s 2005 Kelo v. City of New London decision is notorious enough, but it bears recalling in this connection, for the whole episode is objectionable in so many monitory ways. In the year 2000, the frayed Connecticut city had conceived a grandiose project to redevelop 90 waterfront acres, in conjunction with pharmaceutical giant Pfizer’s plan to build an adjoining $300 million research center. A conference hotel—that inevitable (and almost inevitably uneconomic) nostrum of urban economic-development authorities—would rise, surrounded by upscale housing, shopping, and restaurants, all adorned with a marina and a promenade along the Thames River. Promising to create more than 3,000 new jobs and add $1.2 million in revenues to the city’s declining tax rolls, the redevelopment authority set about buying up the private houses, mostly old and modest, on the site.

Several homeowners refused to sell, however. They loved their houses and their water views. In response, the determined city seized their property under its power of eminent domain. One resident, Susette Kelo, wasn’t giving up her little pink house without a fight, though, and she, along with a few neighbors (including one who’d lived in her house since 1918), sued the city in the state courts, claiming that its action violated the Fifth Amendment’s guarantee that no person shall “be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.” The trial court agreed with Kelo’s reasonable assertion of the government’s fundamental duty to protect rather than invade private property, but the state appeals court disagreed, and ultimately the U.S. Supreme Court upheld the city’s seizure, 5–4.

The Supreme Court’s opinions, on both sides, lay out a dreary history of how a fundamental liberty shriveled. The justices cite a 1954 precedent that imperiously expanded the rationale for eminent domain from the Fifth Amendment’s public use to public purpose to justify urban-renewal projects that tore down vast swathes of supposedly blighted property in order to turn the land over to private developers of better housing. Even if you grant the constitutionality of the new rationale, argued the petitioner in this case—who owned a prospering, unblighted department store within the redevelopment area—creating a “better balanced, more attractive community” was not a valid public purpose. Wrong, said the Supremes, in Justice William O. Douglas’s trademark fatuously whimsical language: the legislature, invoking values that are “spiritual as well as physical, aesthetic as well as monetary,” has the power “to determine that the community should be beautiful as well as healthy, spacious as well as clean, well-balanced as well as carefully patrolled.” Nor need officials, evidently empowered to define public purposes beyond the Constitution’s limited and enumerated scope, deal with property owners on an individual basis in imposing their aesthetic vision on already existing property, so the department-store owner’s liberty and property rights merit no protection from the redevelopment juggernaut.

The Kelo Court also cited a precedent, appropriately from 1984, that is hard to distinguish from a Latin American Communist-imposed land-reform scheme. Because the government owned 49 percent of Hawaii’s land and 72 private landlords owned another 47 percent of it, the state legislature passed a law forcing the private property owners to sell their land to their lessees, for just compensation. The public purpose of this social-engineering megaproject: “eliminating the ‘social and economic evils of a land oligopoly.’ ” Trying to explain his notion of “the tyranny of the majority,” the great democratic danger that he’d designed the Constitution to prevent, Madison began by observing that “those who hold, and those who are without property, have ever formed distinct interests in society.” As the propertyless will always outnumber the propertied, the essence of democratic tyranny is for the poorer many to expropriate the richer few by such “improper or wicked” schemes as voting “an equal division of property,” the furthest-out extreme of tyranny that the Father of the Constitution could imagine. What would he have said about the Hawaii legislature’s property-redistribution edict and the U.S. Supreme Court that ratified it on such a rationale?

Kelo, as the dissenting justices pointed out, makes almost limitless the government’s eminent-domain power. While the Fifth Amendment envisioned transferring one private owner’s property to another—for reasonable compensation—for a turnpike or a canal to which the entire citizenry had access (or, later, a railroad or electricity-transmission line), the 1954 and 1984 precedents that the Court cites at least claimed that the transfer accomplished the direct public purpose of ending a harmful use of property, if only by association in the case of the unblighted department store surrounded by blight. But no one claims that Susette Kelo’s house—or her neighbors’—is blighted, the dissenters observed. The public purpose of “tak[ing] private property currently put to ordinary private use, and giv[ing] it over for new, ordinary private use” is the indirect, secondary one of raising New London’s tax base, meaning that government could order any property razed for a higher-value one, sweeping away single-family houses (especially humble ones) for apartment buildings, churches for stores, or small businesses for national chains. And, the dissenting justices might have added, it makes government officials interested, rather than neutral, parties, since more tax revenue means better pay, health care, and pensions for them.

In 1812, the nation’s retired first chief justice, John Jay, commented on a proposal to take by eminent domain some fields near his Westchester farm and flood them to make a millpond to turn a factory waterwheel. “When a piece of ground is wanted for a use important to the State, I know that the State has a right to take it from the owner, on paying the full value of it; but certainly the Legislature has no right to compel a freeholder to part with his land to any of his fellow-citizens, nor to deprive him of the use of it, in order to accommodate one or more of his neighbours in the prosecution of their particular trade or business,” he wrote. “Such an act, by violating the rights of property, would be a most dangerous precedent.” As for flooding the fields: “It may be said that the pond, by facilitating manufactures, will be productive of good to the public; but will it not produce more loss than gain, if any of the essential rights of freemen are to be sunk in it?” By 1885, however, many states had passed “mill acts,” permitting just such a use of eminent domain to power gristmills—required, like turnpikes and railroads, to serve all comers.

As it happened, getting rid of Susette Kelo’s house—ultimately, New London moved it from its waterfront site rather than demolish it—produced no gain to anyone. In the wake of a merger, Pfizer moved its research facility elsewhere; the redevelopment agency couldn’t raise the necessary financing for the rest of the project, which Pfizer’s withdrawal rendered problematic; and the land sits vacant, generating not a nickel of tax revenue. The only good the decision produced was a slew of laws in many other states severely limiting the use of eminent domain for economic development. In New York, one of eight states without such limits, the official wresting of unblighted property from one ordinary private owner to another politically powerful one for private use continues unabated.

In framing the Constitution, once the Revolution had stopped the tyranny of taxation without representation, Madison realized that even in a self-governing republic, taxes remained the chief source of potential abuse. “The apportionment of taxes on the various descriptions of property, is an act which seems to require the most exact impartiality,” he wrote, “yet there is perhaps no legislative act in which greater opportunity and temptation are given to a predominant party, to trample on the rules of justice. Every shilling with which they overburden the inferior number, is a shilling saved to their own pockets.” A steeply “progressive” tax system, in which the rich pay not just a higher amount but pay at a higher rate than the less affluent, would have troubled him as much as a system whose loopholes allow some rich citizens to pay proportionally less, and he would have heard with dismay—though not with total astonishment, since it was just this kind of danger he knew the country faced—that 47 percent of tax filers now pay no income tax.

But what he could never have imagined is that judges—rather than the legislature—would impose a new system of taxation without representation, a modern tyranny of which the most outrageous of several examples is the New Jersey Supreme Court’s Abbott v. Burke case, still going on after more than a quarter-century. Based on the state constitution’s boilerplate call for the legislature to “provide for the maintenance and support of a thorough and efficient system of free public schools for the instruction of all the children in the State between the ages of five and eighteen years,” the court, in a string of 21 decisions starting in 1985, set out to use the schools to rescue the children of New Jersey’s urban underclass, cost be damned.

The court claimed to know just how Herculean a task it was taking on. Inner-city kids in Newark, Trenton, Camden, and so on had “needs that palpably undercut their capacity to learn,” the judges noted. “Those needs go beyond educational needs[;] they include food, clothing and shelter, and extend to lack of close family and community ties and support and lack of helpful role models.” The children live “in an environment of violence, poverty, and despair, . . . isolated from the mainstream of society. Education forms only a small part of their home life,” and dropping out of school “is almost the norm. . . . The goal is to motivate them, to wipe out their disadvantages as much as a school district can, and to give them an educational opportunity that will enable them to use their innate ability.”

What will accomplish this vast work of cultural and social repair? The judges had read their Jonathan Kozol, they noted, and what they took away from the fanciful, far-left education ideologue’s Savage Inequalities, which compares some of the worst urban high schools—including one in Camden, New Jersey—with some of their very best suburban counterparts, is that the chief difference between successful schools and failed ones is money.

So, flinging aside the concept of separation of powers, the court ordered the legislature to hike its support for specified inner-city districts—and not by the relatively modest amount that the legislature calculated would help these schools meet performance standards it thought reasonable, but rather by the huge amount of money needed to make their per-pupil expenditure equal that of the state’s richest suburban districts. In fact, the court reasoned, the 31 so-called Abbott districts should receive more than the rich districts, because inner-city kids have “specific requirements for supplemental educational and educationally-related programs and services that are unique to those students, not required in wealthier districts, and that represent an educational cost.” Before long, the court had included in these extra programs all-day kindergarten, half-day preschools for three- and four-year-olds (though the state constitution calls for free education to start at age five), and special transition programs to work or to college, plus a ton of money to improve “crumbling and obsolescent schools,” since “we cannot expect disadvantaged children to achieve when they are relegated to buildings that are unsafe”—and that, as Jonathan Kozol would say, contemptuously proclaim that a racist society doesn’t value the kids it dumps there.

Perhaps not averse to shoveling lots more money to unionized teachers and construction workers while claiming to have no other choice, the legislature didn’t resist the court’s encroachment on its constitutional prerogative to set taxes and spending priorities, and it obediently began to fleece the Garden State’s taxpayers with abandon, pushing New Jersey’s state and local tax burden to 12.2 percent of the average taxpayer’s income, the highest in the nation in the Tax Foundation’s latest ranking. As spending on the Abbott districts skyrocketed from 8.9 percent of the state budget in 1985 to 15.5 percent of a much bigger budget last year, suburban taxpayers found themselves paying for two school systems: their own, through property taxes (higher since the suburbs now get much less state aid); and the Abbott schools, through their state income taxes—to the tune of almost $37 billion in the decade from 1998 to 2008, according to a Federalist Society study. Suburbanites with kids in private or parochial school shoulder a third system as well. To fund construction of gleaming new inner-city schools, the legislature authorized $8.6 billion in bonds that pirouetted around constitutionally mandated voter approval—and that covered only half the ultimate cost, given the inefficiency and corruption that riddles the contracting process. And last spring, the court demanded yet another half-billion dollars for the Abbott archipelago, at a time when the sagging national economy makes curbing out-of-control government spending, and separating essential from frivolous efforts, more than usually urgent.

What are New Jersey taxpayers accomplishing with the $22,000 to $27,000 they spend per pupil each year in the big inner-city districts? On test scores and graduation rates in Newark, the needle has scarcely flickered. As the E3 education-reform group’s report Money for Nothing notes, high schools in the state’s biggest city can’t produce substantial numbers of juniors and seniors who can pass tests of eighth-grade knowledge and skills, and the report quotes testimony to the same effect before the state legislature about Camden’s schools.

A remark the Jersey justices made in one of their Abbott decisions suggests why. “Approximately twenty security guards are required to ensure the safety of high school students in Trenton,” the judges say, compared with three or fewer in a suburban school. What kind of school culture does this statement imply? The judges know that “many poor children start school with an approximately two-year disadvantage compared to many suburban youngsters”—because, even with court-mandated preschool, they have vocabularies a fraction the size of middle-class children’s, and they lack a middle-class-level mastery of cognitive concepts like cause and effect, or social skills like sharing, taking turns, sitting still, and paying attention, or a middle-class knowledge base of everything from dinosaurs and donkeys to Rapunzel and Rumpelstiltskin.

And money for a 20-man troop of guards is supposed to help shrink that disadvantage rather than expand it, as the schools do now? To work that rescue, the schools need a vast reformation in their institutional culture so that, as in much less costly parochial schools that succeed with the same youngsters whom the public schools fail, kids behave not because they have a phalanx of guards coldly eyeing them but because they identify internally with the purposes of the school and genuinely want to meet its standards. They need teachers rewarded for merit, not longevity, and a curriculum that stresses skills, knowledge, and striving, not grievance and unearned self-esteem. They need a school culture that expands their sense of opportunity and possibility strongly enough to counteract the culture of militant ignorance and failure that surrounds them in the narrow world they know.

Laudable ends generally don’t justify improper means; but when illegitimate means come nowhere near achieving their indisputably noble goal—when, to paraphrase Chief Justice Jay, government drowns our liberties in a pond that can’t even turn a mill wheel—what justification can there be?

One of the greatest dramas of President Washington’s first term was the showdown between House of Representatives leader James Madison and Treasury secretary Alexander Hamilton over how to interpret the Constitution of which Madison was the moving spirit, and which he and Hamilton had defended and explicated together in The Federalist. Hamilton wanted the government to charter a national bank; Madison argued that doing so would be unconstitutional because chartering a bank was not one of the limited and enumerated powers given to the federal government. It was no good, he said, for Hamilton to claim that the Constitution’s clause empowering Congress to make any law “necessary and proper” for carrying out its enumerated powers would permit it to charter the bank, since a bank wasn’t “necessary” but merely “convenient.” Once you start saying that the Constitution’s “necessary and proper” clause, or commerce clause, or clause to provide for the general welfare gives Congress implied powers, you are setting off on a course that will in the end “pervert the limited government of the Union, into a government of unlimited discretion, contrary to the will and subversive of the authority of the people.”

Nonsense, replied Hamilton: the “criterion of what is constitutional . . . is the end to which the measure relates as a mean. If the end be clearly comprehended within any of the specified powers, & if the measure have an obvious relation to that end, and is not forbidden by any particular provision of the constitution—it may safely be deemed to come within the compass of the national authority.” Congress and President Washington agreed; the bank, once established, sparked an era of golden prosperity; and even Madison learned when he became president that a central bank was indeed necessary, and that interpreting the Constitution requires “a reasonable medium” between trying to “squeeze it to death” and “stretch it to death.” Men of goodwill can disagree on where the line is that would “convert a limited into an unlimited Govt,” but all agree that one can’t overstep that line.

So it was with a certain astonishment that one heard then–Speaker of the House Nancy Pelosi’s reply, when asked two years ago whether President Obama’s health-care plan, which she and her colleagues had just passed into law, was constitutional. “Are you serious?” she said with incredulous contempt. “Are you serious?” With apparently no idea of where her authority came from, she seemed to assume that Congress had power to do whatever it wanted, though her office later announced that the power to force citizens to buy health insurance was implicit in the Constitution’s commerce clause. Congress has, of course, grotesquely stretched the doctrine of implied powers many times since Madison conceded such a thing existed, but here, almost unthinkingly, it stretched it to the breaking point and left the Constitution in fragments on the legislative floor. A year later, federal judges in Florida and Virginia declared the requirement to buy health insurance unconstitutional, as did a Pennsylvania judge this September: the commerce clause, they held, can’t be stretched to make people buy something. If it could, wrote Florida federal judge Roger Vinson, “Congress could require that everyone above a certain income threshold buy a General Motors automobile—now partially government-owned—because those who do not . . . are adversely impacting commerce and a taxpayer-subsidized business.” Now that one federal appellate court has backed Judge Vinson and two others have upheld the requirement to buy health insurance, it will be for the Supreme Court, which received two appeals in the case in late September, to declare whether this time Madison’s nightmare of “unlimited” government finally becomes real.

Nor is this Obamacare’s sole constitutional outrage. To rein in Medicare spending, Obamacare has authorized an appointed panel of 15 “experts,” the Independent Payment Advisory Board, whose power, said Obama’s ex-OMB director, Peter Orszag, will represent “the largest yielding of sovereignty from the Congress since the creation of the Federal Reserve.” To control costs, the board will set reimbursement rates for doctors—which in effect will ration care for Medicare beneficiaries, though the Orwellian law simultaneously forbids explicit rationing—and Congress can overturn the board’s edicts only if it legislates another way to cut Medicare by the same amount. Under some circumstances, which the murkily ambiguous law sets forth in a confusingly vague and broad way, even that congressional tinkering could require 60 votes in the Senate. Nor can Congress kill the board (which, unlike other such agencies as the FCC or SEC, needn’t be even nominally bipartisan) unless it introduces a resolution in January 2017 and enacts it by mid-August by a three-fifths supermajority of all members in both houses—and even then, the resolution can’t take effect until 2020. The Obamacare law isn’t embarrassed to call the executive-branch board’s edicts “legislation,” and it exempts them from judicial or administrative review. So much for the separation of powers.

There’s indeed a lot of petty tyranny going around. The question is, at what point do many little tyrannies add up to Tyranny? Likely voters suggested a troubling answer in an August Rasmussen poll: 69 percent of them said they didn’t think today’s U.S. government enjoys the consent of the governed. And in September, 49 percent of respondents, an unprecedented high, told Gallup pollsters that “the federal government poses an immediate threat to the rights and freedoms of ordinary citizens.”